Tis the season to file your taxes! There are plenty of great resources to help you file your taxes online, but do you have everything you need to begin filing? In the blog below, we have outlined some important areas to consider when filing your taxes.

1. File early to avoid delays

The earlier you file, the earlier you can expect your tax return! The later you file the longer it may take if your tax return is flagged for review. You can expect your quickest return by filing your taxes online and setting up a direct deposit with the IRS.

2. Locate the necessary documents to file

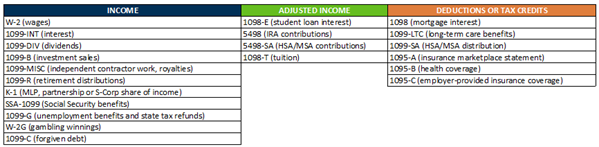

There are all sorts of documents that you may need to use when filing your taxes. Below is a table of the documents you need to consider. Do a little research and see which of these might apply to you:

3. Review previous tax filings

A great place to start when filing your taxes is to review your previous tax filings. A lot of the information on those returns may carry over, so if you have any questions on the options you need to select, referencing an old tax return is not a bad place to start.

4. Make sure your return is filed accurately

Everyone wants to avoid an audit and ensuring that you have filed your taxes correctly is a great way to avoid one! Before you file your return, cross-check the information you have with what the IRS has on file for you. This can be done at https://www.irs.gov/individuals/get-transcript.

5. Review new rules on credits and deductions

Each year that you file, it is important to review the newest rules on credit and deductions to see if you might qualify. Reviewing the new rules can help you reduce your tax bill or collect a better tax return. Also, double-check for any credit and deductions that may no longer apply.

6. Determine if you need to file for an extension

Make the decision as early as possible if you believe you are going to need to file for an extension. If you don’t believe you will be able to get all the information necessary to file your tax return prior to the April 18th deadline, plan to file for an extension now! Being fully transparent with the IRS is important.

If you ever have any questions regarding how to direct your refund to deposit into your CES Credit Union account, feel free to ask a CES Credit Union employee for advice or assistance. Also, be on the lookout for scams related to tax filing, to learn more about what to look for review our blog here, https://bit.ly/3ZtbNsU.