Tax season isn’t the most exciting time of the year, but for some this will mean a tax return could be on the way! If you’re expecting a tax return, avoid constantly checking your bank account and check out the tools below to track your refund and determine when you’re most likely to receive it.

Generally, if you filed electronically, you can begin tracking your refund about 24 hours after your taxes have been filed. Filing electronically is highly encouraged, as you will receive your tax return in a much timelier manner. It is reported that the IRS is still dealing with a backlog of paper tax returns from last year with the filing extension that was put into place, due to the pandemic.

Tools to use:

-

Start by using the IRS tool, Where’s My Refund. To use this tool, you will need to provide your Social Security Number (SSN), your filing status (single, married, etc.) and the amount you’re expecting from your tax return. After you’ve submitted all the relevant information, just hit “Submit” and you should be able to track your refund!

-

For mobile users, you can also download IRS2Go. On this app, you can track the status of your return daily as the data updates. The three statuses you should see are:

-

Received – this is when the IRS has received your field taxes and is processing your return.

-

Approved – this indicates that the IRS has confirmed the amount of your refund.

-

Sent – this will let you know that your tax return is on the way!

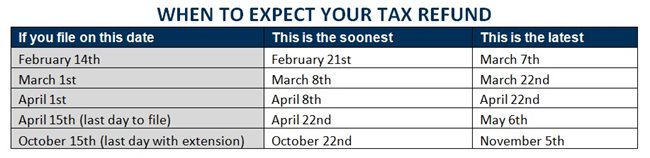

Below are possible dates when you can expect to see your tax return, based on when you filed.

If you have any further questions regarding your tax return, we highly encourage you to reach out to the IRS by phone or on their website at www.irs.gov.