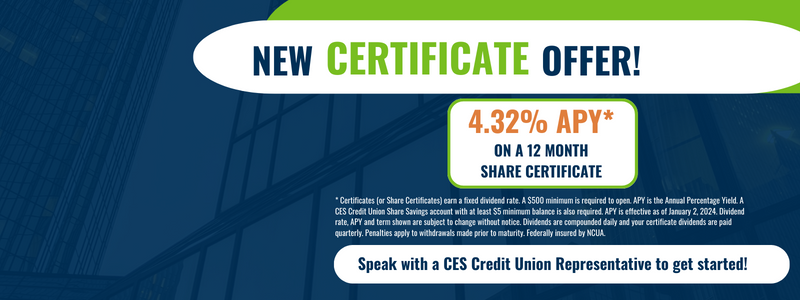

* Certificates (or Share Certificates) earn a fixed dividend rate. A $500 minimum is required to open. APY is the Annual Percentage Yield. A CES Credit Union Share Savings account with at least a $5 minimum balance is also required. APY is effective as of January 2, 2024. Dividend rate, APY and term shown are subject to change without notice. Dividends are compounded daily and your certificate dividends are paid quarterly. Penalties apply to withdrawals made prior to maturity. Federally insured by NCUA.

Certificates

Certificates are a great way to maximize your savings with the security of NCUA backing. With a certificate, you choose the term that fits your financial goals - short term or longer term - while locking in a premium interest rate for the term you choose. These are a great option for saving for future expenses or for putting money away that you don’t plan on using for a length of time.

Certificates can be opened with a minimum of just $500 - that's lower than many commercial banks. Rates may change without prior notice and special rates may be for a limited time. Call or email the credit union for the current rates.

For youth age 17 or younger, there is a unique certificate offer designed just for them. It's a great way to save for summer jobs, or safely stash away that 4-H money. Click here to learn more.

To find out more about NCUA coverage of your deposit,

click here to find out more.

For an estimate on your potential return on your Certificate, visit the Certificate Calculator below:

CERTIFICATE CALCULATOR

.aspx)

IRAs (Individual Retirement Accounts)

It’s never too soon to start saving for retirement—or too late. An IRA offers you a safe and secure option for your retirement dollars with a guaranteed rate of return. We have an IRA option perfect for you no matter what your retirement goals may be.

We offer two types of IRAs:

A Traditional IRA is an account that allows you to defer taxes on your earnings until they are withdrawn. Also, certain contributions may be tax deductible in the year they are made.

A Roth IRA is an account that features tax-free earnings once you have reached age 59 ½ and you’ve had a Roth IRA for 5 years. Since Roth IRA contributions are non-deductible and taxed in the year they are earned, members who expect to be in a higher tax bracket when they retire may benefit more from a Roth IRA than from a Traditional IRA. Unlike the traditional IRA, there is no requirement to begin taking distributions at age 72. There are income limitations for eligibility for a Roth IRA.